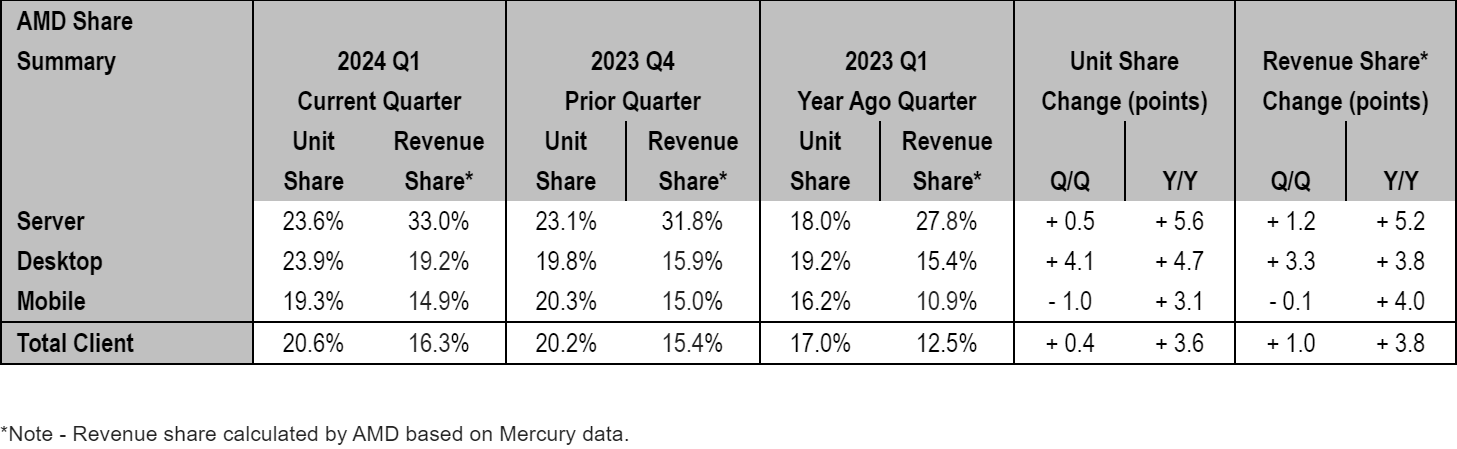

AMD Hits Record High Share in x86 Desktops and Servers in Q1 2024

by Anton Shilov on May 10, 2024 7:00 AM EST

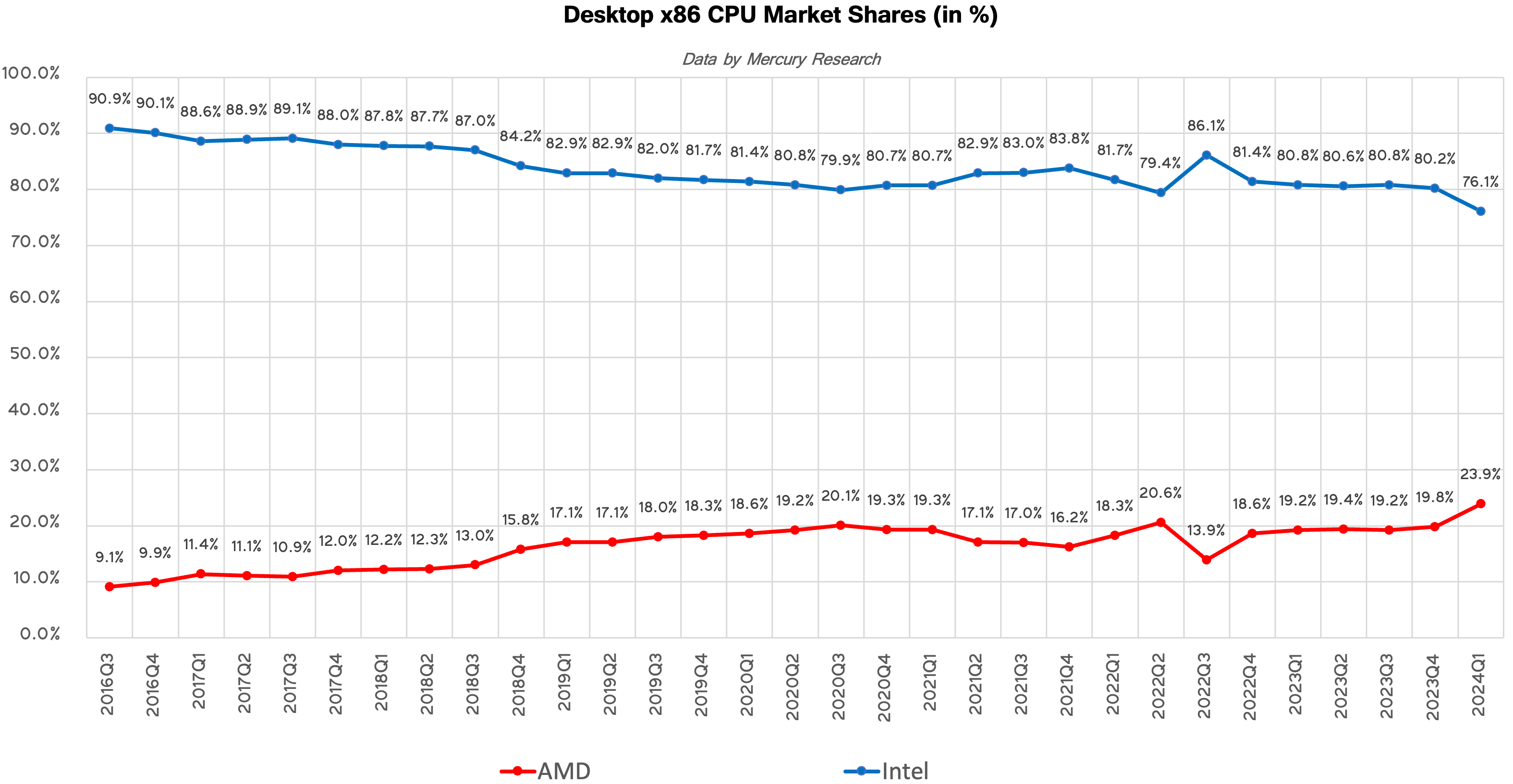

Coming out of the dark times that preceded the launch of AMD's Zen CPU architecture in 2017, to say that AMD has turned things around on the back of Zen would be an understatement. Ever since AMD launched its first Zen-based Ryzen and EPYC processors for client and server computers, it has been consistently gaining x86 market share, growing from a bit player to a respectable rival to Intel (and all at Intel's expense).

The first quarter of this year was no exception, according to Mercury Research, as the company achieved record high unit shares on x86 desktop and x86 server CPU markets due to success of its Ryzen 8000-series client products and 4th Generation EPYC processors.

"Mercury noted in their first quarter report that AMD gained significant server and client revenue share driven by growing demand for 4th Gen EPYC and Ryzen 8000 series processors," a statement by AMD reads.

Desktop PCs: AMD Achieves Highest Share in More Than a Decade

Desktops, particularly DIY desktops, have always been AMD's strongest market. After the company launched its Ryzen processors in 2017, it doubled its presence in desktops in just three years. But in the recent years the company had to prioritize production of more expensive CPUs for datacenters, which lead to some erosion of its desktop and mobile market shares.

As the company secured more capacity at TSMC, it started to gradually increase production of desktop processors. In Q4 last year it introduced its Zen 4-based Ryzen 8000/Ryzen 8000 Pro processors for mainstream desktops, which appeared to be pretty popular with PC makers.

As a result of this and other factors, AMD increased unit sales of its desktop CPUs by 4.7% year-over-year in Q1 2024 and its market share achieved 23.9%, which is the highest desktop CPU market share the company commanded in over a decade. Interestingly, AMD does not attribute its success on the desktop front to any particular product or product family, which implies that there are multiple factors at play.

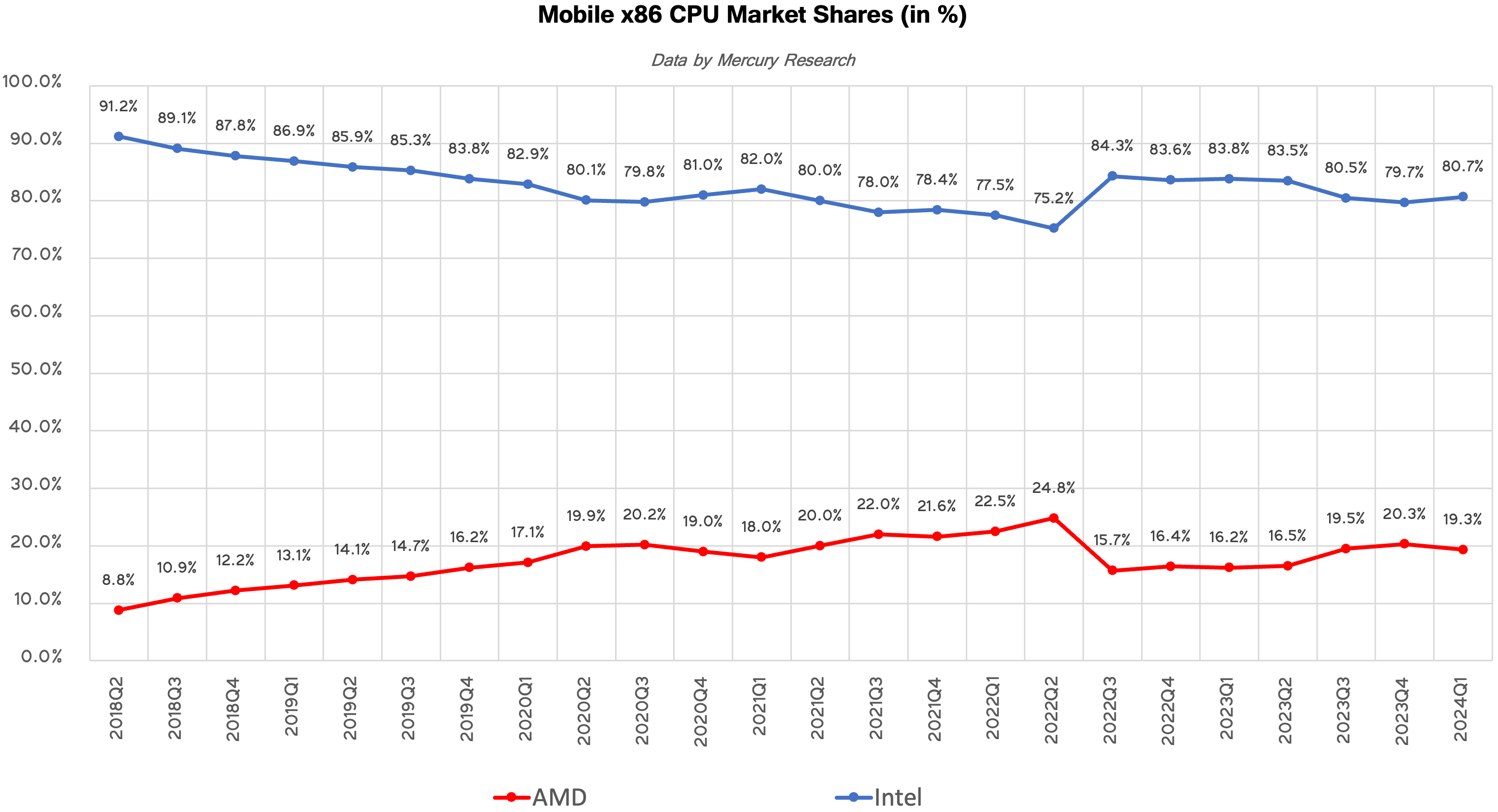

Mobile PCs: A Slight Drop for AMD amid Intel's Meteor Lake Ramp

AMD has been gradually regaining its share inside laptops for about 1.5 years now and sales of its Zen 4-based Ryzen 7040-series processors were quite strong in Q3 2023 and Q4 2023, when the company's unit share increased to 19.5% and 20.3%, respectively, as AMD-based notebook platforms ramped up. By contrast, Intel's Core Ultra 'Meteor Lake' powered machines only began to hit retail shelves in Q4'23, which affected sales of its processors for laptops.

In the first quarter AMD's unit share on the market of CPUs for notebooks decreased to 19.3%, down 1% sequentially. Meanwhile, the company still demonstrated significant year-over-year unit share increase of 3.1% and revenue share increase of 4%, which signals rising average selling price of AMD's latest Ryzen processors for mobile PCs.

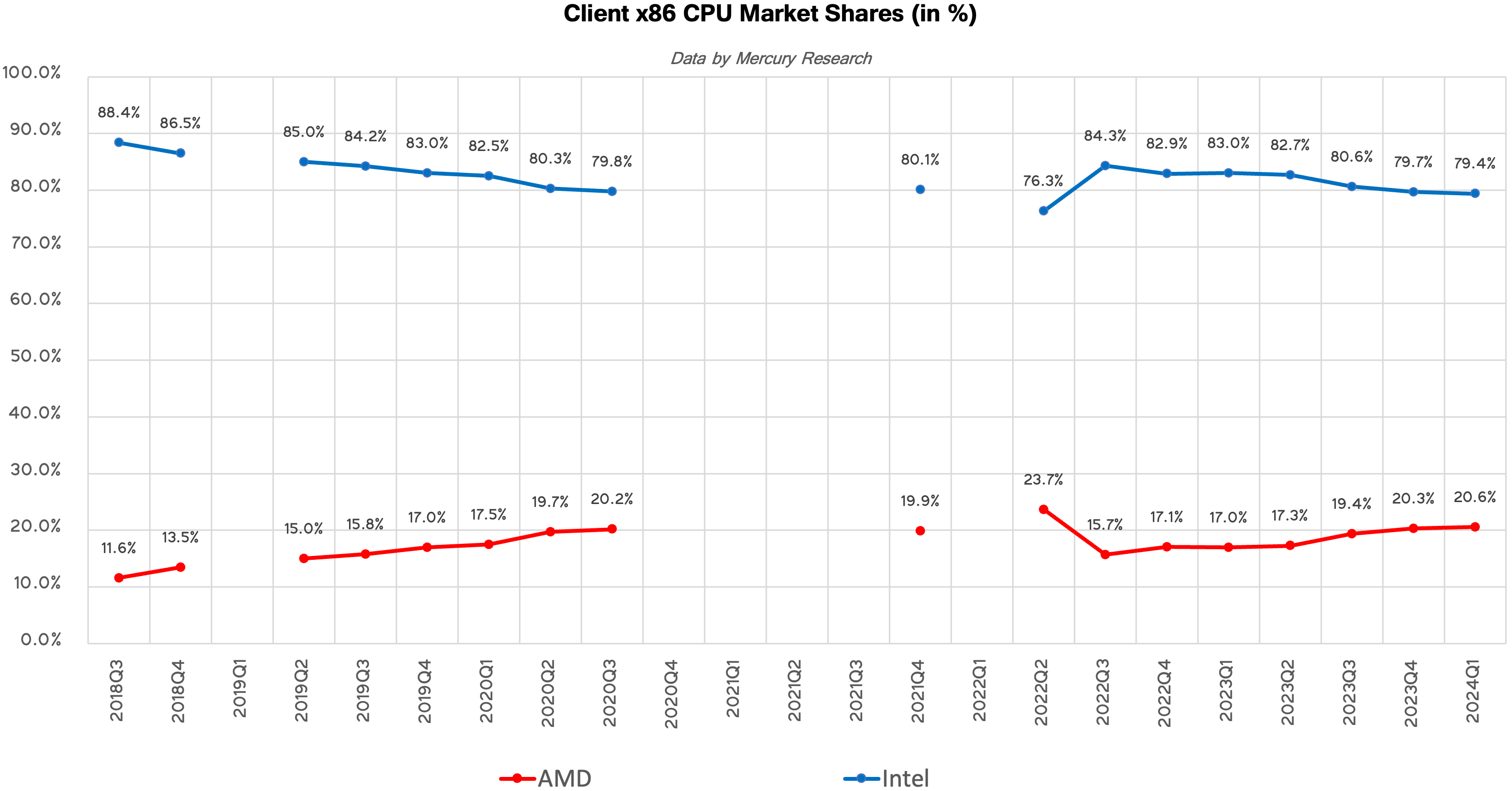

Client PCs: Slight Gain for AMD, Small Loss for Intel

Overall, Intel remained the dominant force in client PC sales in the first quarter of 2024, with a 79.4% market share, leaving 20.6% for AMD. This is not particularly surprising given how strong and diverse Intel's client products lineup is. Even with continued success, it will take AMD years to grow sales by enough to completely flip the market.

But AMD actually gained a 0.3% unit share sequentially and a 3.6% unit share year-over year. Notably, however, AMD's revenue share of client PC market is significantly lower than its unit share (16.3% vs 20.6%), so the company is still somewhat pigeonholed into selling more budget and fewer premium processors overall. But the company still made a strong 3.8% gain since the first quarter 2023, when its revenue share was around 12.5% amid unit share of 17%.

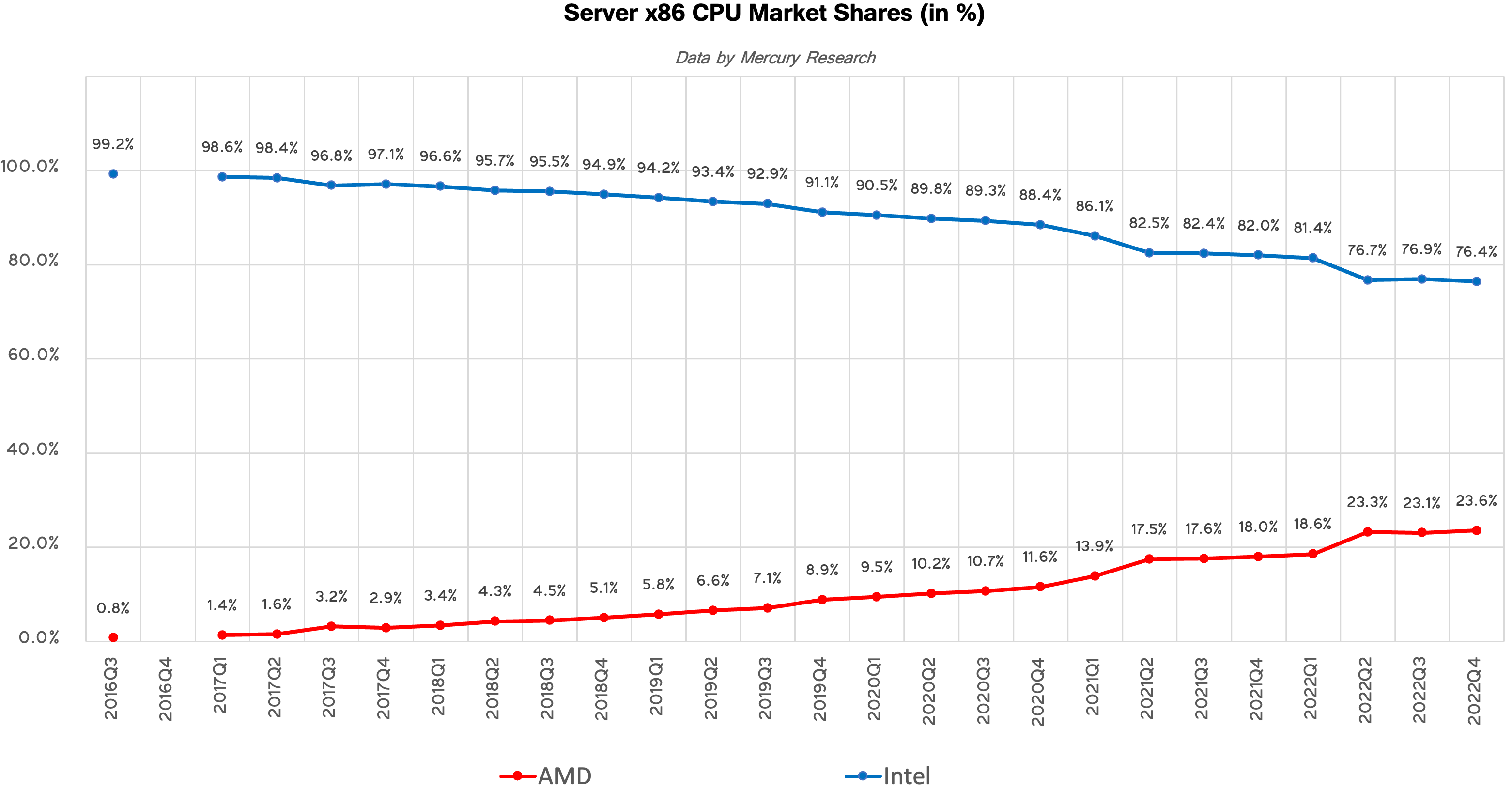

Servers: AMD Grabs Another Piece of the Market

AMD's EPYC datacenter processors are undeniably the crown jewel of the company's CPU product lineup. While AMD's market share in desktops and laptops fluctuated in the recent years, the company has been steadily gaining presence in servers both in terms of units and in terms of revenue in the highly lucrative (and profitable) server market.

In Q1 2024, AMD's unit share on the market of CPUs for servers increased to 23.6%, a 0.5% gain sequentially and a massive 5% gain year-over-year driven by the ramp of platforms based on AMD's 4th Generation EPYC processors. With a 76.4% unit market share, Intel continues to dominate in servers, but it is evident that AMD is getting stronger.

AMD's revenue share of the x86 server market reached 33%, up 5.2% year-over-year and 1.2% from the previous quarter. This signals that the company is gaining traction in expensive machines with advanced CPUs. Keeping in mind that for now Intel does not have direct rivals for AMD's 96-core and 128-core processors, it is no wonder that AMD has done so well growing their share of the server market.

"As we noted during our first quarter earnings call, server CPU sales increased YoY driven by growth in enterprise adoption and expanded cloud deployments," AMD said in a statement.

Source: AMD, based on data from Mercury Research

44 Comments

View All Comments

meacupla - Friday, May 10, 2024 - link

The mobile market is getting spicy.Hawk Point (8040 series) is rightfully a dud since it's just a 7040 series refresh. I have to question why they bothered pushing it through the door. I am barely seeing any show up at stores. It's been what? 6 months since they announced it and I still only see a few 8945HS equipped laptops compared to the numerous Core Ultra 5/7/9 laptops (Some SKUs, like 135H still MIA).

I look forward to Strix Point, X Elite, and Lunar Lake stirring up the market.

Captain obvious - Friday, May 10, 2024 - link

7040 series also pretty much had a paper launch.With some Shenzhen brands (rightfully, probably) throwing tantrums because they didn't get the amount of 7040 chips they bought.

So I am expecting to see Strix being paper launched in Computex, with availability around CES (lol), just in time for Lunar Lake's arrival.

Also curious about the X Elite, another paper launch that by the time it arrives, will compete with a chip 2 refreshes newer than the M2 baseline on the original announcement...

Blastdoor - Friday, May 10, 2024 - link

By the time it ships the best argument for X Elite would be if qcom throws in a free 5g modem.kn00tcn - Friday, May 10, 2024 - link

which stores? what region? recent earnings had client up so could that mean oems are buying more and the resulting laptops will trickle into stock for H2?seeing numerous laptops in stores doesnt necessarily mean they're all selling, if physical retail then it's likely sponsored shelf space due to the low store margins (well it's not shopping season this time of year anyway, though i did get a ryzen laptop in may of a different year)

and some benchmarks have shown hawk point has more of a gain over phoenix than expected

meacupla - Friday, May 10, 2024 - link

Amazon, Bestbuy, Walmart, newegg, etc. online stores. North America.I just checked today. The only Ryzen 8000 anything that shows up is 8945HS.

Blastdoor - Friday, May 10, 2024 - link

It's really kind of amazing that AMD's desktop marketshare never got anywhere close to a majority. There were several years where AMD had a clearly superior design on a superior process. Of course, Intel's margins contracted a lot during that period, so I guess AMD had an impact in that way.I suspect AMD is near peak marketshare in all segments, though. Intel moving to 20A while AMD is stuck on TSMC N4 is going to hurt.

kn00tcn - Friday, May 10, 2024 - link

intel is also losing hyperthreading, and when will they have 3d cache?process node isnt everything, a mash of performance + power + price (+manufacturing cost) are what matter

diy desktop likely has been majority for a while, but prebuilts, oems, institutions? that's a lot of stock that needs to be guaranteed mixed with old contracts and momentum, i would never expect majority yet

Blastdoor - Friday, May 10, 2024 - link

Losing hypterthreading is a feature not a bug. Intel has efficiency cores to help with MT performance -- AMD doesn't have those (although they are adding their 'c' cores).Process node isn't everything, but it's a lot and absolutely affects performance and power. The only way for AMD to beat Intel by using an inferior process is if AMD has a much better design. That was the case with Athlon vs. Netburst. I doubt it will be the case moving forward.

Samus - Saturday, May 11, 2024 - link

The real problem with hyperthreading now is how easily it has been exploited for security vulnerabilities, and the protections required along with the fact most pipelined 'hyperthreads' aren't hits for multiple factors (bad queuing, under-prioritized branch prediction, collisions requiring discard, etc) don't make it a compelling performance improvement compared to other options. While its kind of "free" performance, it's not as big as it used to be two decades ago when Jackson technology was announced.GeoffreyA - Saturday, May 11, 2024 - link

So, Intel has had, with Skylake, Sunny, and Golden Cove, better performance per watt than their Zen counterparts?